Introduction #

Configuring the energy profile in the Qilowatt app ensures that your system correctly calculates energy purchase, sales, and network costs. This allows the Optimizer to make accurate decisions based on your specific electricity contracts and tax setup.

Prerequisites #

• Qilowatt account created → Creating a user account

• Device connected to WiFi → Connecting a device to WiFi

• Inverter added to the Qilowatt app → Module setup

• Solar plant and battery data correctly configured → Solar inverter setup

• Device connected to WiFi → Connecting a device to WiFi

• Inverter added to the Qilowatt app → Module setup

• Solar plant and battery data correctly configured → Solar inverter setup

Step-by-step Guide #

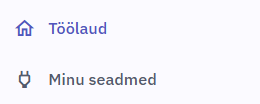

1. Open device information #

• Log in to the Qilowatt app and from the left menu, under Dashboard or My Devices choose the programmable device (e.g., Qilowatt Modbus R2).

• On the device page, locate the Device Info section and click Edit

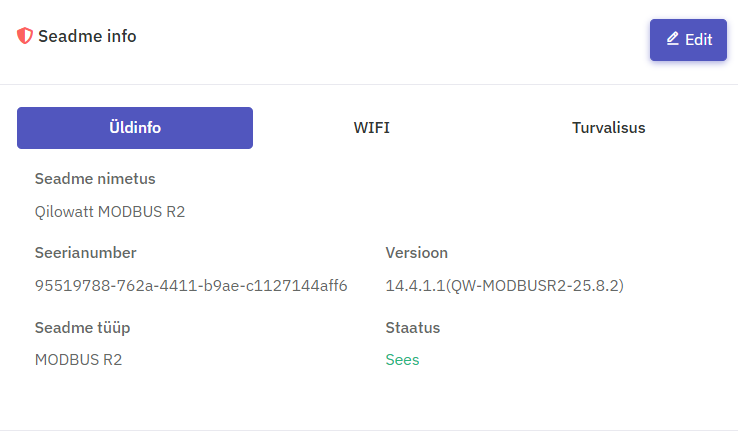

2. General View #

Currency precision.

Select how energy data should be displayed:

• €/kWh – in euros;

• c/kWh – in cents.

Select how energy data should be displayed:

• €/kWh – in euros;

• c/kWh – in cents.

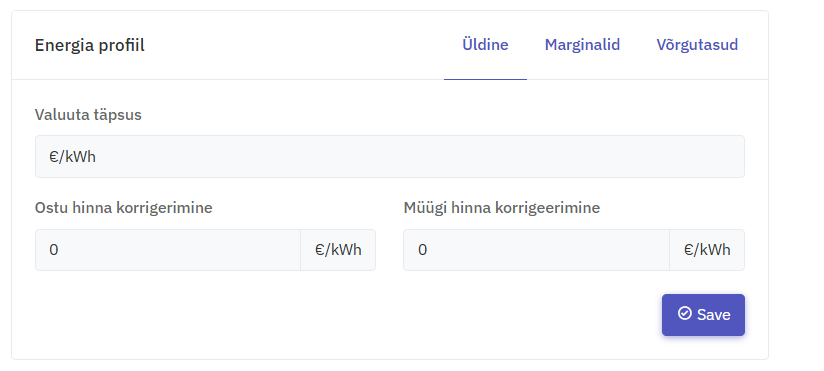

3. Margins configuration #

Purchase margin

The purchase margin consists of the sum of five components. All parts must be calculated without VAT. The VAT rate is added in a separate field and the system calculates it automatically.

a) Margin added by your energy supplier to the exchange price. You can find this in your electricity contract. For example, 0.305 cents/kWh.

b) Electricity excise duty (0.21 cents/kWh as of 01.01.2026)

c) Renewable energy fee (0.84 cents/kWh as of 01.01.2026)

d) Balancing capacity cost (0.373 cents/kWh as of 01.01.2026)

e) Security of supply fee (0.758 cents/kWh as of 01.01.2026)

In this example: 0.305+(0.21+0.84+0.373+0.758) = 0.305 + 2.181 = 2.486

The purchase margin consists of the sum of five components. All parts must be calculated without VAT. The VAT rate is added in a separate field and the system calculates it automatically.

a) Margin added by your energy supplier to the exchange price. You can find this in your electricity contract. For example, 0.305 cents/kWh.

b) Electricity excise duty (0.21 cents/kWh as of 01.01.2026)

c) Renewable energy fee (0.84 cents/kWh as of 01.01.2026)

d) Balancing capacity cost (0.373 cents/kWh as of 01.01.2026)

e) Security of supply fee (0.758 cents/kWh as of 01.01.2026)

In this example: 0.305+(0.21+0.84+0.373+0.758) = 0.305 + 2.181 = 2.486

Sales margin

The sales margin consists of the sum of two components and must be entered as a negative value:

a) Intermediary fee you pay to the energy buyer. This margin is specified in your electricity contract. Make sure the units are correct and consistent! For example, if your contract states a sales margin of 0.01 €/kWh, this equals -1 cent/kWh.

b) Balancing capacity cost for production (i.e., sales). 3.73€/MWh + VAT, which equals 4.6252 €/MWh or -0.46252 cents/kWh

In this example: 1+0.46252=1.46252 * -1, which equals -1.46252

• If you receive renewable energy support of 5 cents/kWh (facility built before the end of 2020), enter the value as 0, because the new fees combined with the margin are lower than the support payment.

• If the owner is a company, the balancing capacity cost for production may also be calculated without VAT.

The sales margin consists of the sum of two components and must be entered as a negative value:

a) Intermediary fee you pay to the energy buyer. This margin is specified in your electricity contract. Make sure the units are correct and consistent! For example, if your contract states a sales margin of 0.01 €/kWh, this equals -1 cent/kWh.

b) Balancing capacity cost for production (i.e., sales). 3.73€/MWh + VAT, which equals 4.6252 €/MWh or -0.46252 cents/kWh

In this example: 1+0.46252=1.46252 * -1, which equals -1.46252

• If you receive renewable energy support of 5 cents/kWh (facility built before the end of 2020), enter the value as 0, because the new fees combined with the margin are lower than the support payment.

• If the owner is a company, the balancing capacity cost for production may also be calculated without VAT.

Purchase VAT

• Private person – pays VAT on the purchase price (24%)

• Company – does not pay VAT (0%)

• Private person – pays VAT on the purchase price (24%)

• Company – does not pay VAT (0%)

Marginaali pealt genereeritakse uued müügihinnad. Kui hind läheb negatiivseks, piiratakse müük automaatselt 0 €/kWh pealt. Toetuse saajatel ja mitte-saajatel on nullpunktid erineval hinnatasemel.

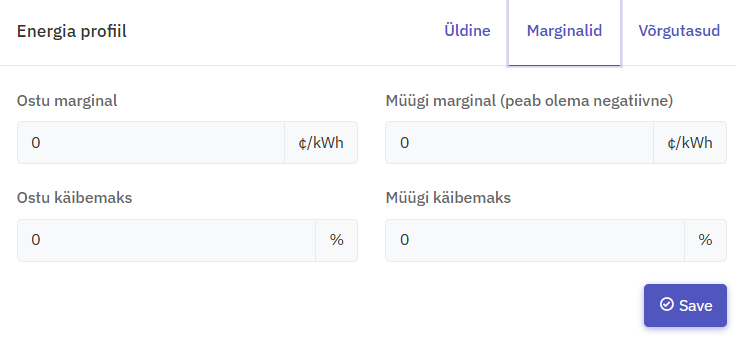

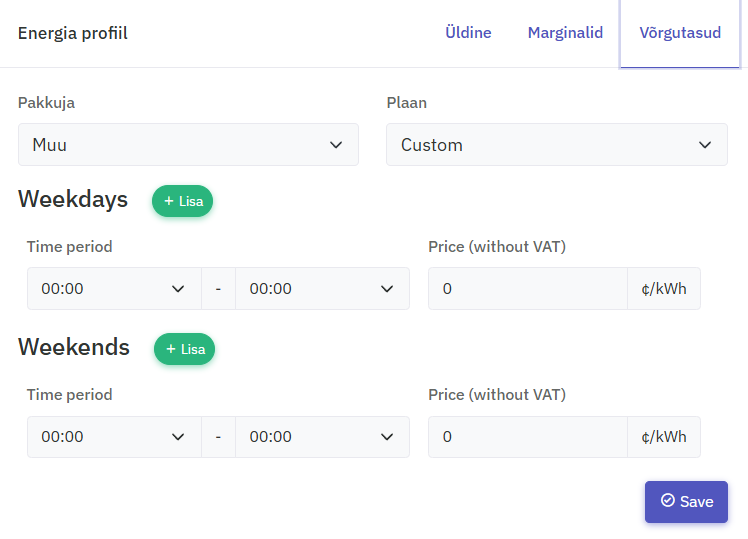

4. Network fees configuration #

Provider and Plan

• Select your Energy Partner (provider) from the dropdown

• Choose the appropriate Network Plan

• Select your Energy Partner (provider) from the dropdown

• Choose the appropriate Network Plan

Entering prices

• Enter your network fees according to your plan

• Prices must be entered excluding VAT

– Example: Daytime price 3.69 c/kWh

– Nighttime price 2.10 c/kWh

• If applicable, set different values for weekdays and weekends

Once all data has been entered, click Save.

• Enter your network fees according to your plan

• Prices must be entered excluding VAT

– Example: Daytime price 3.69 c/kWh

– Nighttime price 2.10 c/kWh

• If applicable, set different values for weekdays and weekends

Once all data has been entered, click Save.

Result #

Your energy profile is now configured. Qilowatt uses these parameters to calculate energy costs, revenues, and optimize energy flows in real time.

If it Doesn’t Work #

• If the system does not respond as expected, check the margin values.

• If sales happen at a loss, ensure that the sales margin is entered as a negative value.

• If the problem persists, contact the Qilowatt support team: support@qilowatt.eu

• If sales happen at a loss, ensure that the sales margin is entered as a negative value.

• If the problem persists, contact the Qilowatt support team: support@qilowatt.eu